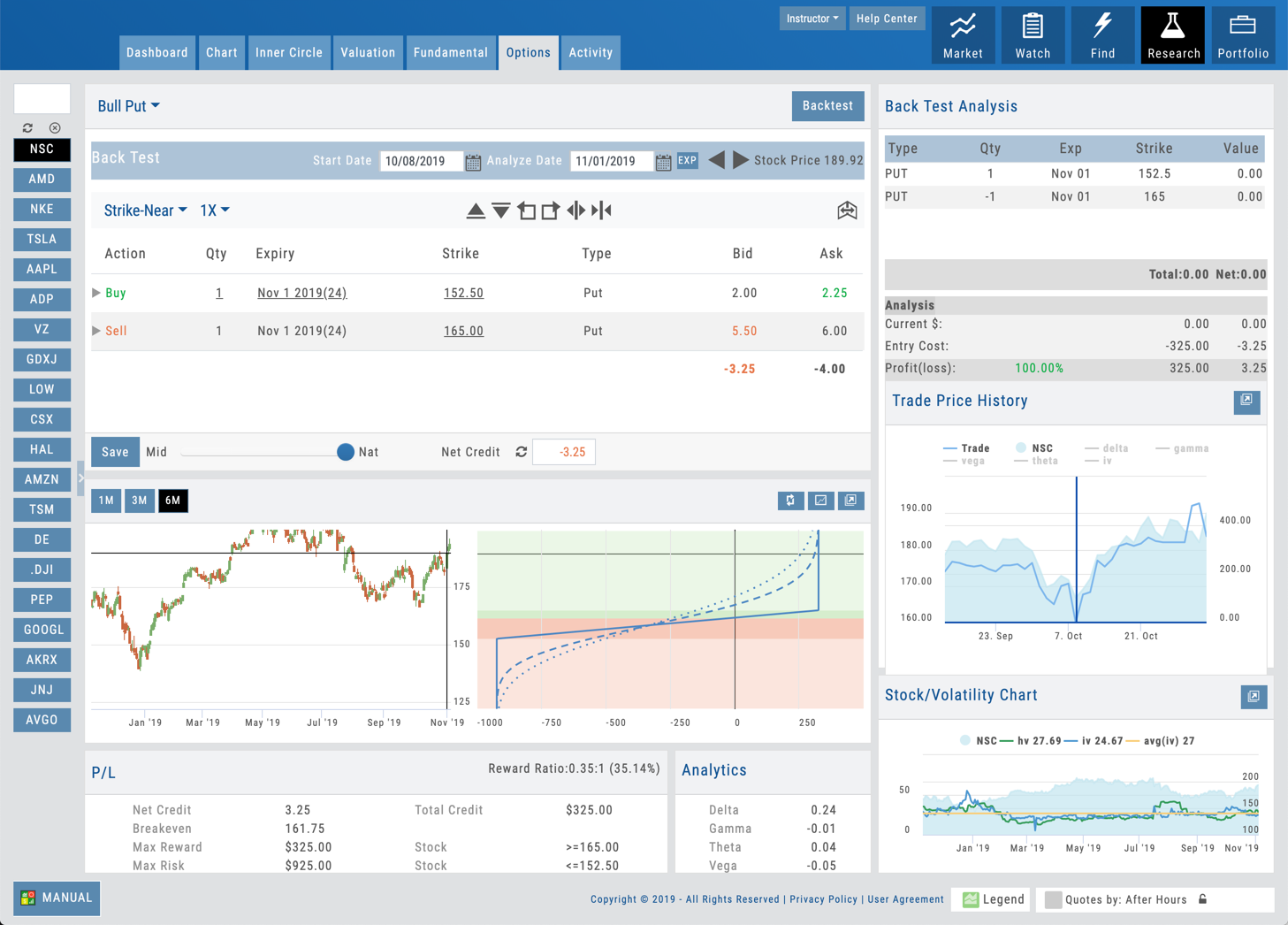

Backtesting

Our backtesting module shows you a day by day view of how your trade would have played out. In addition, you can compare up to three trades to see what would have worked better. We offer 15 years of stock and options data for backtesting.

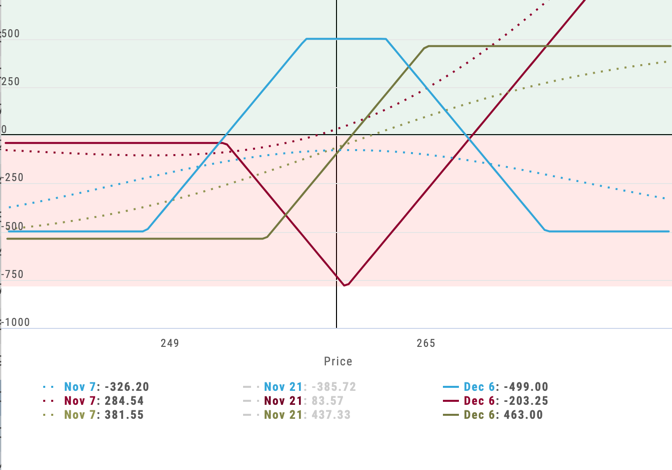

Put It On the Chart

iVest+ was designed with backtesting in mind. You can run backtests and display them on charts so you can see when and how they would have played out and visually view the entries and exits.

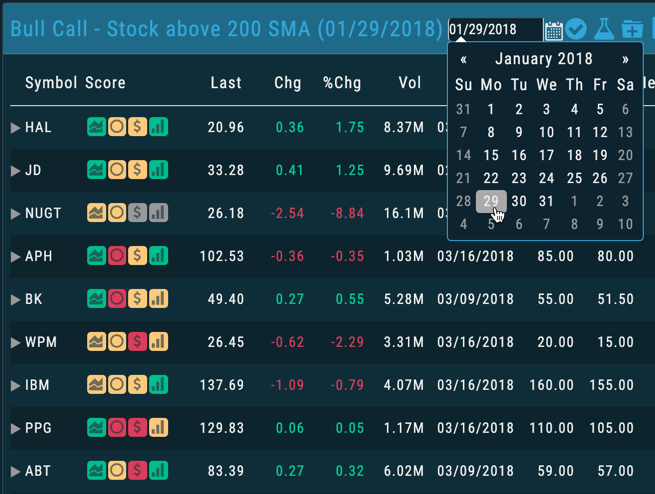

Get Confident

Build a quicker understanding of the various strategies and learn how they would work over time. Our scans are designed to make you profitable, but our backtesting helps you see how. Pick any day in the past and see what the scans would have turned up, then analyze how the trade would have worked.

Post-Trade Risk Analysis

Even after you complete a trade, you can backtest it to see how it performed day-by-day and learn how you could have done better. Backtesting includes all of the calculations in one place: Risk/reward, breakeven, gains, and even net Greeks.

Backtesting Solutions for All Your Trading Needs

The iVest+ platform was designed to help all traders backtest various strategies. Whether you are looking at all trade types or honing in on a specific strategy, we give you the visual and statistical tools to know how trades would have worked.

Your Broker.Your Choice.

Broker Integration

There is a good chance that you or your customers already have an account that connects to our product. We have integrated with the top names in the industry through various brokerage APIs. Getting started is simple, and if you don’t already have an account with one of these brokerages, you can typically open one in a day.